Integrating the Cashback System Into Any Business: Everything Covered

Cashback works because it rewards behaviour customers already intend to do. They buy, you give a small amount back, everybody feels good about the exchange, and you quietly shift the numbers that actually matter—average order value, repeat purchase rate, and lifetime value. The art is in the integration. Get the design and tracking right, and cashback becomes a reliable growth lever rather than an expensive hobby.

This guide walks you through everything required to integrate a cashback system into any business, whether you run an online shop, a marketplace, a subscription app, or a services brand that takes bookings.

Cashback integration in one line

A cashback system is a structured promise to return a small portion of the purchase price to the customer once the transaction is confirmed. The precise amount varies by merchant, category, device, new versus existing customer, and any exclusions you set. The system lives across product, engineering, finance, legal, and marketing, so the integration touches far more than a single button on the checkout page.

The business case, why cashback works

- Reduces friction for first purchase. A modest reward nudges fence sitters to try you now instead of next week.

- Protects margin while increasing frequency. You do not discount every product for everyone. You target rewards to moments that matter.

- Builds habits. Cashback creates a reason to return that feels fair and repeatable.

- Improves measurability. Clear click → purchase → payout steps are easier to evaluate than fuzzy brand campaigns.

If you already run affiliate activity, cashback slots in naturally. If you do not, you still use the same ideas, tracking clean events and paying out when returns or cancellations are no longer a risk.

Cashback models you can choose

1) Merchant funded cashback

You fund the reward from your own margin. Works well for direct-to-consumer brands where you control pricing and shipping. Lets you vary rates by category or customer segment.

2) Affiliate funded cashback

You earn an affiliate commission from a network or partner, then pass a share back to the customer. Common for marketplaces or multi-brand publishers. Requires excellent tracking and reconciliation.

3) Card linked offers

Customers link a payment card and earn cashback automatically when they spend at participating stores. Great for offline and omnichannel, requires partnerships with card networks and stricter compliance.

4) Wallet based credits

You credit an internal wallet or points balance that can be used on a future purchase or withdrawn. Good for retention; brings accounting and KYC responsibilities.

5) Hybrid models

Mix approaches, e.g., merchant funded on core SKUs and affiliate funded with partner retailers, paid into the same wallet for a consistent experience.

Design your programme before you touch code

Define the goal

Pick a single measure of success for the first 90 days: new customer activation rate, repeat purchase within 45 days, or uplift in average order value. Tie your cashback rules tightly to this goal.

Choose the funding source

Decide what pays for each unit of cashback, your margin, affiliate commissions, co-op budgets, or a blend. Decide early to avoid messy accounting later.

Set the rules

- Rates: base rate by category/device/customer type; temporary boosts for campaigns.

- Eligibility: exclude high-return categories, gift cards, or specific payment methods if needed.

- Stacking: define how cashback interacts with coupons, bundles, or staff discounts.

- Hold period: time between purchase and approval to cover returns/chargebacks.

- Expiry & breakage: when wallet balances expire, and how you will notify customers.

- Payout thresholds: minimum to redeem, maximum per transaction, currencies supported.

Plan the customer journey

Show the reward on product, basket, and checkout. After purchase, show pending cashback. When the hold period ends, approve and notify. Simple, visible, and predictable beats clever.

Technical architecture, the pieces you will build

Event tracking baseline

Track click, session, add_to_cart, checkout, purchase, refund. Attach stable identifiers (user id, session id, device, marketing params). Consistency here saves weeks later.

Order ingestion and attribution

Decide how an order becomes eligible. For affiliate-funded cashback, rely on network tracking and a server-to-server postback carrying your SubIDs. For merchant-funded, use your order DB and rules. Either way, match the order to a user/click history, then calculate the provisional reward.

Wallet and ledger

Build two layers: the user wallet (balances & history) and a double-entry ledger that records every movement: pending, approved, reversed, withdrawn. Ledgers keep finance and auditors happy.

Payout engine

Support methods your customers expect (bank transfer, UPI, PayPal, store credit, mobile money). Each method has limits, costs, and KYC rules. Abstract providers behind a common interface so you can add/switch later.

Admin and operations console

Controls for rates, exclusions, bulk adjustments, manual approvals, disputes. Add search by user, order id, date range. Log every change with user + timestamp.

Notifications

Template transactional messages: pending confirmation, approval after hold period, payout success, low balance reminders, expiry warnings.

Data and privacy

- Store only what you need for attribution; avoid personal data in query strings/SubIDs.

- Publish a readable disclosure explaining what you track and why.

- Respect regional privacy laws; consent banners must actually control the tools they claim to control.

- If you allow withdrawals to bank accounts, prepare for KYC/AML checks, even for small programmes.

Fraud and abuse to expect, and how to defend

Common patterns

- Self-referrals/duplicate accounts for sign-up bonuses.

- Order-return cycles that harvest cashback then refund.

- Abusive stacking (coupons + gift cards + cashback) that kills margin.

- Device resets/private browsing to evade rate limits.

Controls that work

- Velocity limits by device, IP range, and payment instrument.

- Hold periods matched to returns and delivery timelines.

- Exclusions for high-risk categories/payment routes.

- Privacy-respecting device fingerprinting.

- Behaviour flags for unusual values/patterns, routed to manual review.

- Clear terms and visible enforcement so abuse is not worth it.

Financial modelling, set rates you can live with

Example for a £100 order:

| Item | Amount | Notes |

|---|---|---|

| COGS | £70.00 | — |

| Gross margin | £30.00 | £100 − £70 |

| Payment & fulfilment fees (2%) | £2.00 | 2% of sale |

| Cashback promise (5%) | £5.00 | Customer sees this |

| Assumed breakage (20% of cashback) | £1.00 | Unredeemed |

| Redeemed cashback | £4.00 | £5 − £1 |

| Net contribution | £24.00 | £30 − £4 − £2 |

Without cashback you’d keep £28 after the same fees. The difference is £4. With a 30% margin, you need roughly £4 ÷ 0.30 ≈ £14 extra order value to break even, or higher repeat rate. Price rates per category accordingly.

Implementation roadmap, six phases that ship

Phase 1: scope and compliance

Write goals, rules, and funding sources. Draft plain-language Ts&Cs, update privacy notice, add a short disclosure on all templates mentioning cashback.

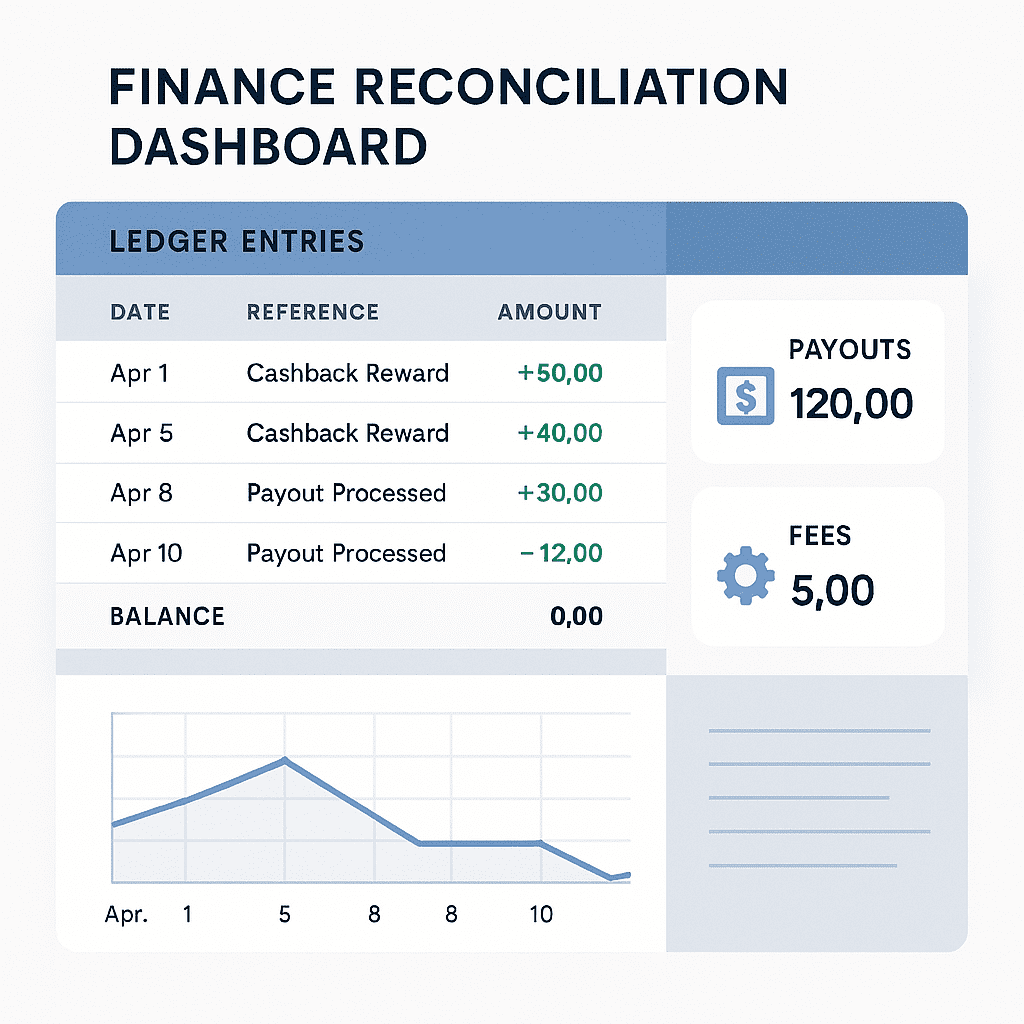

Phase 2: data model and ledger

Tables for users, orders, clicks, wallet balances, ledger entries. States for every reward: pending, approved, reversed, withdrawn. Build idempotent upserts.

Phase 3: attribution and eligibility

Implement rules deciding qualification. For affiliate flows, capture SubID on click, receive postback, match user. For merchant-funded, match by user/session. Log denial reasons.

Phase 4: wallet, UI, notifications

Wallet page with pending/approved sections, clear dates, link to rules. Emails/push for pending, approval, payout.

Phase 5: payouts & reconciliation

Integrate one payout method first. Build daily reconciliation for withdrawals (success/fail), update ledger, provide finance exports.

Phase 6: experiments & iteration

Launch with one base rate + one boost. Measure 2–4 weeks. A/B rate, placement, or message. Keep winners, retire the rest.

On-site placement and copy that convert

- Near price on PDP: “Earn £5 cashback today on eligible orders.”

- In cart: show total pending cashback and link to rules.

- Checkout: no surprise exclusions; clarity reduces tickets.

- Order confirmation: show pending cashback in page/email.

- Approval: celebrate lightly and make next action obvious (spend/withdraw).

Keep copy concrete. People ignore vague promises and trust numbers they can see.

Personalisation that actually helps

- By customer type: first-time boost vs rhythm boosts for repeat buyers.

- By category: higher rewards where margins are healthy and returns low.

- By predicted churn: targeted boost if no order in 90 days.

- By channel: smaller boosts on app if retention is strong; keep web rates stable.

Start with two or three rules that are easy to explain. If your team cannot explain the logic, customers won’t trust it.

Measurement plan, what to track and how to read it

North star metrics

- Repeat purchase rate (e.g., within 45 days).

- Average order value (AOV).

- Contribution margin after cashback and fees.

- Redemption rate & breakage.

- Time to second order.

- Wallet balance distribution (unused balances).

Diagnostics

- Approval lag (purchase → approval).

- Reversal rate by category/device.

- Top support topics (exclusions, delays).

- Fraud flags and manual reviews per 1,000 orders.

Test & learn rhythm

Change one meaningful variable at a time. Leave long enough to reach significance. Keep a simple log of hypothesis → dates → result.

Real world examples

- D2C fashion: merchant-funded 3% base, 7% boost on accessories for 8 weeks. AOV +£18; returns stable; boost becomes seasonal lever.

- Marketplace (affiliate partners): passes 50% of commission to shopper; 7-day hold; excludes gift cards/digital goods; approval emails day 8 with breakdown, disputes drop.

- Subscription app: cashback on first month only; loyalty points for renewals, strong acquisition without overpaying habitual users.

Legal and finance basics to address early

- Advertising standards: promises must be truthful; don’t hide exclusions.

- Terms & conditions: plain language; hold periods, expiry, dispute handling.

- Accounting treatment: approved but unpaid cashback is a liability; maintain a clear ledger and monthly reconciliations.

- Tax: check VAT/GST impacts if funded from margin vs promo expense.

- KYC/AML: withdrawals to cash may require identity checks depending on region.

None of this needs to be scary. It just needs to be written down and followed.

Common pitfalls and how to avoid them

- Launching with too many rates and exceptions, start simple, layer complexity only where it proves value.

- Hiding exclusions in small print, clarity now saves bigger headaches later.

- Ignoring the ledger, spreadsheets will break under audit.

- Paying out before returns settle, use the hold period.

- Treating cashback as a one-off campaign, the value comes from steady, predictable operation.

FAQs

How big should my cashback rate be?

Start with what your margin supports (often 2–8%). Test from there. The right number lifts profitable behaviour for your categories.

Cash withdrawals or store credit?

Both can work. Cash boosts perceived value; store credit improves retention. If possible, support both and nudge toward store credit with small, sustainable bonuses.

How long should the hold period be?

Match your return window and shipping realities. Fast-moving goods: 7–14 days. Longer-return categories: extend accordingly.

Can cashback work for services?

Yes. Bookings/subscriptions respond well when rewards reduce the first-purchase barrier. Define “completed service” clearly.

What if I already run coupons and seasonal sales?

Define stacking rules. Often it’s either coupon or cashback (except special events). Make the rule visible before checkout.

Summary

Integrating a cashback system is less about a plug-in and more about orchestration. Decide the goal, set clean rules, track events predictably, and honour the promise with tidy operations. Do that and cashback becomes a durable growth lever that customers like and finance respects. Skip the groundwork and you’ll chase reversals and explain inconsistencies.

For tailored advice on rates, ledgers, and rollout planning or if you are looking for complete end to end development, feel free to contact Cusenware.